What is a spread?

Below we explain what a spread is in the market

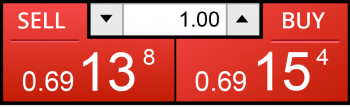

The spread is difference between ASK and BID price.

It represents the fee we charge you for trading with us. Spread is traditionally denoted in pips (a percentage in point), meaning fourth decimal place in currency quotation. You can work out the spread on our trading platform by looking at the sell and buy price and the difference between the two prices is the spread.

In this example of the New Zealand Dollar against the United States Dollar, the sell price is 0.69138 and the buy price is 0.69154 The difference between the price is or the spread is 0.00016 which is 1.6 pips spread.

When trading you will either buy or sell a specific product when you place a trade. A profit will be made once the price has moved position in your favour and covered the cost of the spread after a trade has been placed. The other situation, for example, is when the price has moved in your favour but hasn’t covered the spread, or the price went against you, and a losing trade has occurred. The major part of the costs involved in CFD trading is the spread cost.

A smaller spread indicates a better value for a you. In the addition to the spread some brokers also charge a commission, RockGlobal does not charge commission on most of its products.