The S&P 500 has experienced a notable drop from 4,075 points on Tuesday, March 7th, to 3,850 points by Friday, March 11th, representing a decrease of approximately 5.5% in just four days. This significant decline in the index is attributed to various factors, including the collapse of Silicon Valley Bank, rising bond yields, inflation concerns, and fears of a potential interest rate hike. Over the last four weeks, the US500 has declined by 6.60 percent, while over the last 12 months, its price has fallen by 7.40 percent.

On Thursday last week, the Dow Jones saw a significant drop of 345 points, while the S&P 500 and the Nasdaq also experienced losses of 1.4% and 1.7%, respectively. The main focus for investors was the collapse of Silicon Valley Bank, which became the biggest bank failure since 2008, prompting regulators to take control of the Californian bank after its shares sank sharply. The downfall of the tech-focused lender also impacted other banks.

Silicon Valley Bank's share sale to shore up its balance sheet amid losses from bond sales was doomed by a run-on deposit, leading to the bank's collapse. This news overshadowed the latest jobs numbers, which showed that US employers had hired more workers than expected in February. The nonfarm payrolls increased by 311,000, indicating strength in the job market.

However, unemployment unexpectedly rose to 3.6%, and wage inflation cooled, easing some concerns that a still-tight labour market would prompt sharper interest rate hikes. Overall, it was a tough week for the stock market, with the Dow experiencing its worst week since September, down 4.5%, while the S&P 500 and the Nasdaq lost 4.9% and 5.5%, respectively. Investors will be closely watching for any further developments in the financial sector and the job market, which have significant impacts on the economy and the stock market.

Comments

- When the RSI drops below 50, it is usually interpreted as a bearish signal, indicating that selling pressure may be increasing and momentum is shifting towards the downside. The fact that the RSI on the S&P 500 4-hour chart has dropped below 50 points and is currently at 46 points, sliding downwards, suggests that there is increasing selling pressure in the market, and the bearish momentum is gaining strength.

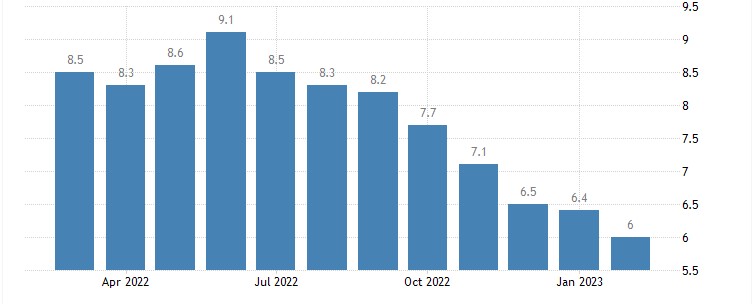

The US inflation rate has continued to be a major concern for the economy, with the latest figures showing signs of a slowdown. The annual inflation rate decreased to 6% in February 2023 from 6.4% in the previous month, in line with market expectations. However, the current inflation rate remains three times higher than the Federal Reserve's target of 2%, highlighting the need for continued action.

In this week, investors will need to keep a close eye on several key events that could impact the markets. Events to watch includes, banking sector turmoil and central bank monetary policy decisions, including the Fed, BoE, SNB, and Norges Bank. Inflation figures for Japan, UK, and Canada, and Zew Economic Index for Germany will provide insight into economic sentiment, while PMI data for major economies will show the health of the manufacturing and services sectors in March, giving an indication of the pace of economic recovery and inflationary pressures.

XAU/USD – – Gold Prices Surge 2% to Reach 8-Month High Amidst Global Banking Turmoil and Inflation Concerns

Gold prices rose by 2% to reach $1,960 an ounce on Friday, the highest level seen since April 2022. This surge was primarily driven by investors flocking to safe-haven assets amidst the global banking turmoil that originated in the US, which sparked concerns about broader weakness in the global economy. Furthermore, expectations that major central banks would adopt a more accommodative stance on inflation to avoid a severe recession also supported gold prices.

On the data front, preliminary estimates showed a surprise drop in US consumer sentiment in March. Meanwhile, the ECB raised its policy rate by 50 basis points, despite the vulnerability of some European lenders, citing potential benefits to bank margins.

Looking ahead, investors will be closely monitoring the Federal Reserve's policy decision next week, which is expected to deliver a modest 25 basis point rate increase considering the recent banking turmoil and easing inflationary pressures. Overall, gold is set to post a weekly gain of 5%, the most in 4-1/2 months, as investors continue to seek out safe-haven assets amidst ongoing economic uncertainty.

Wall Street Extends Gains on Positive Economic Indicators and Hopes of an End to Fed's Rate-Tightening Cycle