What is GDP and how does it impact the financial markets?

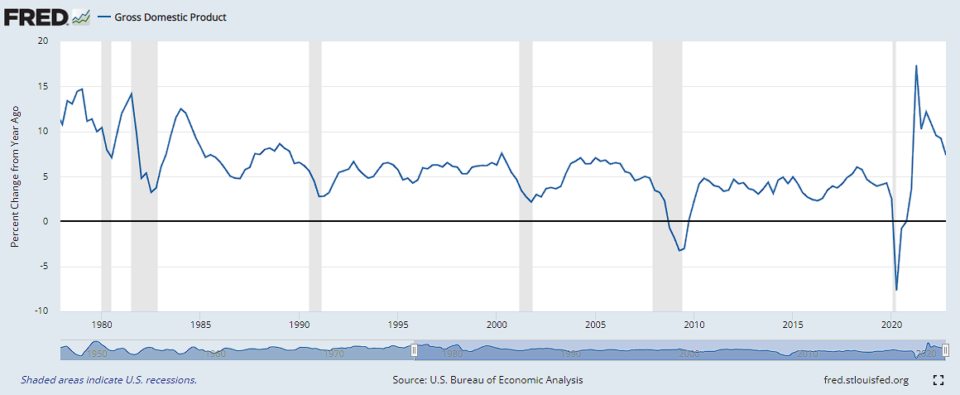

The Gross Domestic Product or GDP for short is one of the important economic indicators for a country. It is a measure of a nation’s economic output. Economists view the GDP as a measure of the health of an economy and hence put the GDP under scrutiny.

Whether you are a day trader or a long-term investor, GDP is one of the three key economic indicators that you cannot ignore. For retail forex traders or day traders, you will often see a lot of volatility in the markets during the GDP release.

Understanding what GDP is, what it measures and its impact on the financial markets will be key to managing your trades. The most important aspect is that the GDP outcome is not binary. Meaning that a better GDP will not result in higher markets, or a lower GDP result in the markets crashing.

Investors and day traders alike need to build the context surrounding the GDP release and the central bank narrative.

GDP measurement is critical to businesses and investors, and day traders alike. Since it indicates the health of an economy, it has a strong impact on the financial markets. In this article, we will discuss the effects of GDP on the financial markets.

Specifically, we will look at how GDP impacts some big markets like bonds, stocks and currencies.

What is GDP or Gross Domestic Product?

GDP is the measure of the value of all goods and services produced in a country, measured over a period of time. This period of time is typically a quarter (in some cases it can also be a month, but the results under such measure can be subject to a lot of revisions).

When we talk about the “value of all goods and services” it takes into account, some as simple as manufacturing beverage bottles, to providing accounting services. Goods and services that are also exported overseas fall into the GDP measure.

This means that if you work for a multi-national company headquartered in some other country, but the services you provide are from your country, this is also accounted for in the GDP measure.

Gross domestic product has a strong impact on the financial markets. Obviously, due to the fact that a healthier economy leads to more economic activity (ex: employers of a company purchasing homes, buying a vehicle, investing in the markets and so on).

As you can see from this little example, the impact of GDP has far and wide-reaching consequences. Thus, it is not surprising that investors, economists and even government officials keep a close eye on the GDP measure.

Many governments often set GDP targets and prepare plans (including budgets) to achieve this GDP growth. This is why you will often see during a GDP release that news articles also mention whether the actual GDP hit the government’s target or not.

How is GDP measured?

No matter which economy you take, the underlying factors in measuring GDP remain the same. There may be a few differences in what accounts for a GDP measure, but the broader calculation of GDP remains the same.

GDP is measured in three main ways, which are categorized as production, income and expenditure-based approaches.

In the production method, the GDP is measured as the sum of the value of all goods and services that were created within the economy or the country. Only the final value of the goods and services are included in order to avoid double counting. To enable national statisticians to measure production, they require data on the value of the goods produced across all industries.

In the income approach, GDP is measured by adding the income earned by households and businesses in the country. Taking into account aspects such as wages, profits (from investments) and other such measures. Statisticians need the income data from the two main groups to arrive at the GDP via the income approach.

In the expenditure approach, GDP is measured as a sum of the spending on the final goods and services. This accounts for not just households and businesses but also governments and foreigners living in the country.

Although the three approaches to measuring GDP may differ, in theory, they should arrive at the same number. But due to various discrepancies such as the data sources, estimates and so on, the actual number may vary quite a bit.

What is the impact of GDP on the financial markets?

At a very high level, positive GDP growth is seen as higher economic activity and thus (for businesses), it can lead to higher profits. This in turn leads to higher wage growth and higher employment.

In short, a positive GDP can tend to influence higher consumption leading to higher interest rates. A positive GDP phase is also known as an expansionary cycle.

Conversely, negative GDP growth leads to lower economic activity and thus lower income or wages. This may curb spending or consumption. Consequently, central banks cut interest rates in order to encourage businesses and individuals to borrow.

Lower GDP impacts, inflation, and the labor market, all of which have an impact on other aspects of the economy.

While this remains the broad scope, many a time, actual data may not spur the expected change. For example, when central banks try to cool down or curb spending they may be forced to raise interest rates.

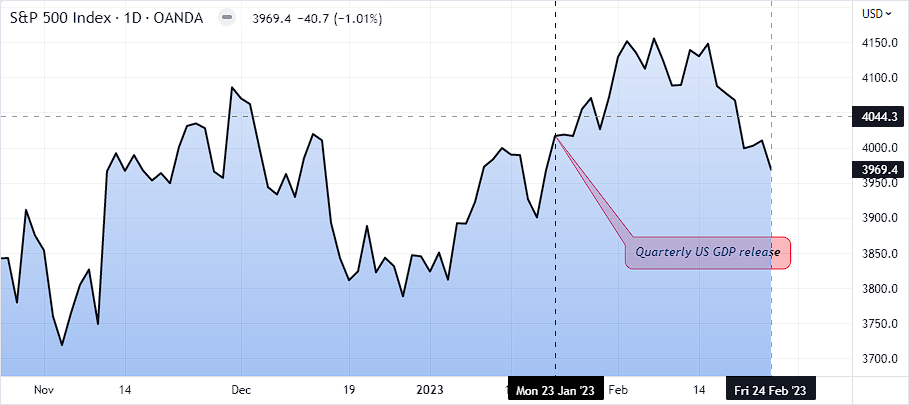

But if the economy continues to grow strong, a stronger GDP result could potentially lead to weaker stock markets (since they expect interest rates to rise higher and more rapidly).

Since the financial markets are very interlinked, you can expect to see each of the markets behave accordingly. Stock markets may fall, pushing the bond market higher, while the currency markets may behave differently.

Let’s take a look at each of these markets in more detail to understand how GDP impacts these markets specifically.

Impact of GDP on the stock market

The stock or the equity markets are perhaps the most widely followed markets. Changes in the GDP report can positively or negatively impact the stock markets. Broadly speaking, a positive GDP has a positive influence on the stock markets.

After all, since GDP measures the value of goods and services generated in the economy, it tends to reflect in the stock market as well. When publicly listed companies are doing good business, it also reflects in the stock markets.

However, it should be noted that the stock market reaction is not always as simple. For the most part, investors look at the general market expectations. Hence, even if GDP was positive, but failed to rise at the same pace as the markets expect, you can see a negative reaction from the stock markets.

But broadly speaking, positive GDP means a growing economy, which in turn has a positive influence on the stock market.

Impact of GDP on the bond markets

In the bond markets, investors closely observe the yields. An interesting fact about the bond markets is that they move inversely to the stock markets. In other words, during a positive GDP release (and depending on the context), the bond markets usually fall.

In other words, yields tend to fall against a rising economy. Conversely, when the GDP declines, the bond yields tend to move higher. When observing the bond markets, it is important to note that yields fluctuate due to the fact that investors’ expectations of interest rates change.

GDP after all, is one of the components that a central bank looks at. Therefore, during economic recessions, interest rates will be lower. Hence, the bond markets anticipate this and therefore the yields tend to fall.

When the GDP is rising, bond investors anticipate a change in the central bank’s interest rates. Thus, bond yields anticipate this change and hence move higher.

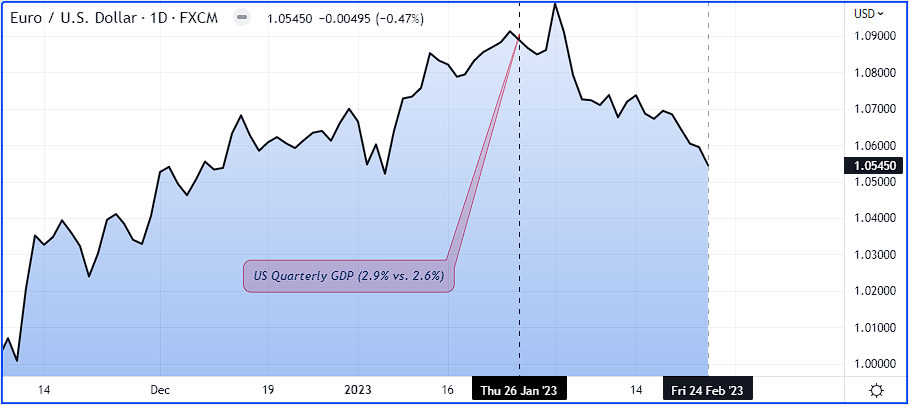

Impact of GDP on the currency markets

The currency markets can be very volatile around a GDP release. Due to this volatility, GDP is one of the key economic indicators that traders look to. Since GDP eventually translates to interest rates, the currency markets tend to price this in.

A higher GDP, as mentioned in the bond market section tends to raise expectations of higher interest rates. Therefore, in the currency markets, demand for the currency also rises due to the higher yield (because of higher interest rates).

This makes the currency more attractive and hence pushes the relative value of a currency higher. When there is an economic contraction, the currency markets reflect this by falling. Since there is now a wide expectation of an interest rate cut, investors find that the currency does not yield that high an interest, pushing it lower.

Bear in mind that GDP is just one of the many economic indicators that can influence a currency. Hence, other factors such as inflation rate, and unemployment should also be taken into account.

What are the factors that can impact GDP?

There can be a number of factors impacting the GDP of a country. These can range from fiscal or government policies to geopolitics as well as the general sentiment of an economy. Central banks closely watch GDP as they can foretell whether the economy is growing or showing signs of shrinking.

Depending on the country in question, GDP can increase for example on the back of increasing government spending. Hence, it is important for investors to look at government policies from time to time. Typically, governments publish their GDP targets for the year.

Key events such as budgets, and trade decisions play an important role. Economists already assess these factors to estimate whether the policies will have a positive or a negative impact on the GDP. Consumer spending is another key aspect of GDP growth.

When there is more money in the economy, consumer spending tends to rise, which in turn has a positive impact on an economy. Thus, factors such as inflation expectations, and consumer surveys always tend to give a glimpse into what one can expect from an economic standpoint.

Frequently Asked Questions about GDP

Does the GDP always impact the financial markets?

GDP release impacts the financial markets, no doubt. However, the intensity of the impact can vary depending on the underlying narrative. For example, if the GDP is the key component for the central bank to decide on whether to raise or cut interest rates, then investors will be closely observing the data to anticipate what the GDP result will do for the fed.

How often is GDP data released?

The Gross domestic product is released typically over a quarter. However, some economies such as Canada publish GDP on a monthly basis as well. The more frequent a GDP release is, the higher the chances that it will be revised in the next release.

How to read the GDP report?

When it comes to understanding GDP, let’s start with the economic calendar. The economic calendar will show the period for which the GDP data is measured. You can also find the market expectations (based on a survey of economists) for the GDP release. Revisions to the previous GDP are usually under the ‘previous revisions’ section.

The Actual is the number that matters. If the actual GDP number is lower than the market expectations, it can sour the mood in the markets. Likewise, an upbeat GDP release that beats estimates can send the equity markets soaring.

Where can I find out about upcoming GDP releases?

The GDP release schedule is found in almost any economic calendar. Depending on the country in question, the GDP release can be quarterly or monthly. Simply select the country you are interested in and then look for the GDP releases which usually happen during the first part of the month.

Some economies also provide flash GDP estimates which is a good way to anticipate any potential changes to the economy.

Conclusion – GDP and its importance for investors

To conclude, GDP is one of the key economic indicators that is widely watched. It can impact a range of financial markets as it is closely watched by central banks. GDP outcome can impact interest rates positively or negatively.

Since the world is now globally interlinked, trade and other aspects form an important factor in the GDP growth of an economy. A slow down for example in a developed economy can impact a developing economy too, especially if this developing economy is reliant on exports.

Hence, investors need to be savvy when it comes to assessing what impact GDP can have on interest rates and central bank decisions. Whether you are trading forex or fixed income or stocks, the gross domestic product economic indicator is definitely worth keeping an eye on.