Options trading is one of the many ways traders can hedge against the underlying asset.

Known as a derivative instrument, options, as the name suggests are OTC or over the counter financial instruments.

Options are one of the many ways an investor can hedge against their portfolio. In order to understand how options works, traders should know what derivative instruments are, how they work, and how to use them.

This article gives an overview for beginners on how to use options derivative contracts.

What are options?

Options are financial instruments that derive prices from the underlying instrument.

Purely speculative in nature, options contracts allow traders to hedge against their exposure to the underlying asset. Depending on the type of financial asset that you use, there are different types of options.

An option gives the holder the right but not the obligation to exercise the contract. This is where we get the term option or optionality.

Optionality is the main difference between option contracts and other derivatives.

For example, if you bought a forward or a futures contract, you have to exercise the contract upon expiry. This is an obligation of both the buyer and seller.

The seller of the contract is obliged to deliver the underlying asset as per the futures or forward agreement. Similarly, the buyer of the futures or forward contract is obliged to take delivery of the underlying contract.

With options, there is no such obligation. Hence, if you don’t want to exercise the contract, you have the option to walk away from the contract without exercising it.

The most common types of option contracts are:

- Stock options: Stock options, as the name suggests make use of the options contracts but for stocks. Using stock options, traders can hedge the stock portfolio

- FX options: Similar to stock options, the main difference is that the underlying financial asset here are the forex currency pairs. Using FX options, traders can take speculative positions in the markets.

- Financial futures options: These options include various financial futures such as interest rates, fixed income among other asset types.

- Credit options: The credit options are derivative contracts that focus on the credit markets. The most common credit options are the credit derivative options or CDO’s. CDO stands for credit default option.

How do options work?

Options, as mentioned earlier are derivative instruments used for hedging purposes.

An investor may purchase 1000 shares in a company. The investor expects the value of the company to rise over a five-year horizon.

However, during this period, the share price may fluctuate. This can lead to volatility in the investor’s portfolio. To hedge against these drops, the investor may use an option.

The option contract is insurance against a large price drop in the shares of the company.

There are two main components in an option.

Strike price: The strike price is the price at which the option can be exercised. The strike price does not have to equal the underlying asset’s price.

Option Expiry: The expiry time is the time when the option will expire. Upon expiration, the contract can be exercised or closed.

The expiry time can range between one month and up to a few years.

A strike price of $10 with an expiry of one year means that the option can be exercised in a year’s time if the share price is higher or lower than $10.

What determines this is the type of option contract you buy.

Types of options contracts

An investor can buy two types of options. CALL and PUT options.

CALL option: A CALL option is used when the investor believes that the market will move higher. An investor who purchases a CALL option believes that the price of the underlying asset will rise upon the expiration date.

A CALL option that expires in the money is when the underlying stock price is greater than the strike price. Conversely, a CALL option expires out of the money when the underlying stock price is below the strike price.

A CALL option expires at the money when the strike price is equal to the underlying asset’s current price.

PUT option: A PUT option is used when the investor believes that the market will move lower. Purchasing a PUT option is viewed as bearish. However, for hedging purposes CALL options are commonly purchased.

A PUT option expires in the money when the underlying share price is below the PUT option’s strike price. A PUT option that is out of the money is when the underlying share is price is above the PUT option’s strike price.

Lastly, when the PUT option’s strike price is equal to the underlying asset’s price, it is at the money.

The PUT option becomes a hedge against the investor’s portfolio where they are long on the underlying asset.

For example, an investor purchased 100 shares in Microsoft at $100. They plan to hold these 100 shares for a few years. But there is a risk that the share price may plummet.

To avoid the risk of losing their investment, the investor can purchase PUT options on Microsoft. This enables them to profit if there is indeed a drop in the share price.

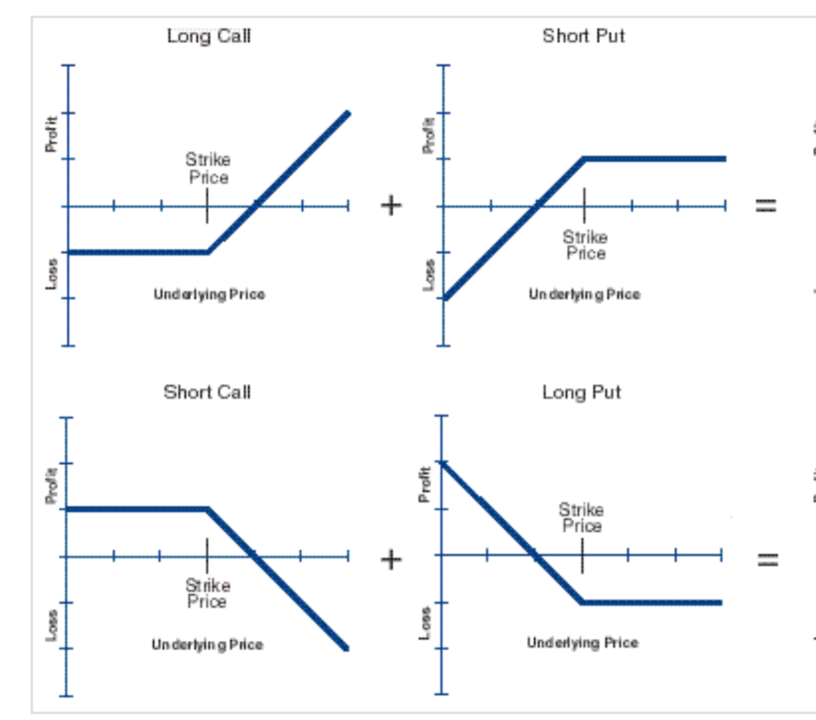

The chart below illustrates examples of Long/Short CALL and PUT options.

Option contract specifications

Because option contracts are traded mainly over-the-counter, the contract specifications can vary. This is especially true for FX options. The contract can be customized to the buyer’s requirements.

Equity options on the other hand follow a standardized specification. These can vary depending on the exchange where they are traded.

The Chicago Board Options Exchange or CBOE is one the most popular options trading exchange. Other names include Intercontinental Exchange or ICE where you can trade options.

For the average investor, you can buy options from your options trading broker.

One equity option contract = 100 shares of the underlying equity

Option contracts are also leveraged (like forex). Since one equity option contract equals 100 shares in the underlying equity, the leverage is 1:100.

Option contracts expire on the third Friday of the contract month. If the third Friday happens to be a holiday, then the contract expires on Thursday, before the holiday.

Option buyer and seller

When you buy an option contract you must pay a fee, which is called the premium.The premium is charged by the seller or the underwriter of the option contract.

In many cases, the options trading brokerage becomes the seller of the contract. As a seller, the options trader takes the opposite view.

The below table illustrates the difference between the option buyer and the seller views on the markets.

| Type | Option Buyer | Option Seller |

| CALL | The buyer takes a long position in the contract The buyer expects price of the underlying asset to rise | The seller takes a short position in the contract The seller expects price of the underlying asset to fall |

| PUT | The buyer takes a short position in the contract The buyer expects price of the underlying asset to fall | The seller takes a long position in the contract The seller expects price of the underlying asset to rise |

Why would anyone invest in options?

Options contracts allows investors to hedge their risks. These contracts are usually purchased by investors who have an actual stake in the underlying asset.

However, even speculators can use options trading to make money.

The main difference between an options contract and other financial derivatives is that the risks are known upfront.

If you are a buyer and your contracts expired out of the money, the maximum amount you can lose is the premium that you paid.

On the other hand, if you are a seller and the contract was exercised by the buyer, you are obliged to deliver the underlying asset (which is 100 shares per contract).

Hence, the downside is much higher as an option seller.

Example of an equity option trade

An investor purchased 100 shares in Adobe Inc. (ADBE) in July 2020 at $450 a share. In total, they invest $450 x 100 shares = $45,000.

The investor has a time horizon of one-year after which they plan to sell the shares. Between this one year period, the share price can go higher than $450 or lower than $450.

If the share price falls below $450, the investor of course loses money. To hedge against this risk, the investor buys a PUT option contract with a one-year expiry time at a strike price of $450.

What this means is that if the stock price falls below $450 at the end of one year, the investor can exercise the option. If the option falls to $400 and the strike price is $450, that is a difference of $50.

In total, this would become $50 x 100 = $5,000.

At the same time, the investor’s portfolio value falls by $5000. But the profits from the PUT option net out the losses in the underlying investment.

The above is the simplest example. There are other factors to consider such as the premium paid, brokerage fees and commissions to account for.

When properly hedged, options contracts can allow an investor to limit their losses.

What happens when the option expires out of the money?

Taking the same example as above, if the stock price rises, then the PUT option expires out of the money.

The investor makes profits on their investment no doubt, but they lose the premium paid on the PUT option.

The losses on the option trade are considered as the insurance premium they paid to risk against a drop in the equity.

The most important aspect of options contracts is that investors should be aware of the strike price and the expiry date. If you get any of these wrong, the option will be worthless, and you lose your premium.

The options contract allows the investor to hedge against downside risks, without having to liquidate their holdings in the underlying asset.

How are options priced?

The prices of options are determined based on the value of the security that it is based on. Hence, there is a correlation between the actual prices of the asset and the option price.

When purchasing options, traders need to remember a few more concepts.

Premium: The premium is the upfront fee you pay to purchase the option. The seller or the underwriter gets the premium for the risk they take. Premium is the maximum amount that you can lose when an option expires out of the money.

Premium is usually denoted as a dollar value per share. And since options contracts (equities) equal to 100 shares in the underlying, you should multiply this by 100. A premium of $2 means that the total premium you would pay to, but one option contract is equal to $200.

The premium price is determined based on factors such as intrinsic value, which is the relationship between the stock price and the option's strike price.

Other factors determining the premium are the time decay (time until the option expiry) and volatility in the underlying asset.

There are various pricing models one can use in the options market. The most common is of course the Black Scholes model. This pricing model determines the fair value or the theoretical value for an option (CALL and PUT). It accounts for six underlying variables such as volatility, option type, underlying asset price, time, option strike price and the risk-free rate.

Pros and cons of trading options

As you have learned so far, options are speculative instruments and with this, it carries its own risk profile. Traders, therefore, need to understand if they want to use options or other derivative instruments.

The table below summarizes the pros and cons of options contracts.

| Pros | Cons |

| Cost effective way to hedge against the underlying asset | Not as liquid as the underlying asset. Therefore, choosing options on less traded assets may incur liquidity risk |

| Potential to make high returns if options expire in the money | Time decay of options can erode the option premium |

| Varied strategies to minimize risks | Commissions on options are typically higher than other derivative contracts |

| Options contracts available for just about any underlying market | More complex than standard financial instruments |

In conclusion, options trading may look simple in theory but hard to trade in real. Traders need to have a good understanding of the various option Greeks. The option greeks are different financial measures on the sensitivity of the option’s price.

The entire approach to trading options is quite different comparing to the underlying stocks or other standardized markets.

Still, many traders fall back upon options trading. If understood correctly, options contracts are a great way to hedge risks in the stock markets.