One of the most popular buzzwords in the financial markets in the past few months is inflation. Just about every country across the globe is reeling under the impact of high inflation. Be it the United States, Turkey or even New Zealand.

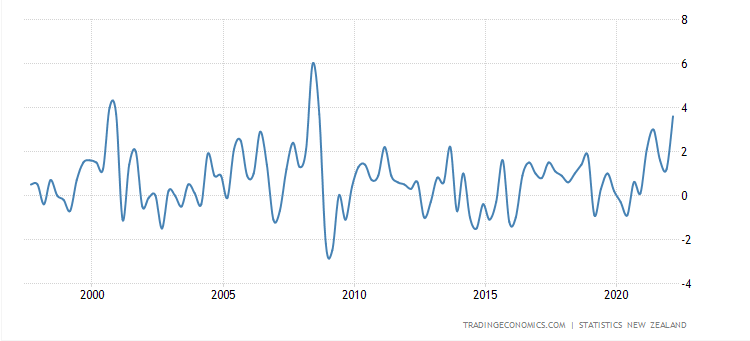

In New Zealand alone, consumer prices or inflation as it is commonly called rose to 7.3% in the June 2022 quarter. The annual inflation rate comes following a 6.9% increase in March this year.

Recent economic articles show that New Zealand's inflation of 7.3% is the highest since 1990. This should not come as a surprise if one has been following the markets closely.

The same trend continues across the globe as central banks fight to tame inflation. When people talk about inflation, the first thing that comes to mind is obviously higher prices. From everyday goods to transportation and just about everything else.

The above chart shows a glimpse of inflation or consumer prices since early 2000. As evident, the current inflation is the highest ever seen. This begs the question of what inflation is and how it impacts prices.

More importantly, what are the consequences of higher inflation on an economy? In this article, we aim to give you the inside look into what inflation or consumer prices are all about. It is not just for a regular audience but also from a trading perspective.

We will also look into the driving factors behind the current inflation and what central banks are doing to contain inflation across the world. But first, let’s get started with the basics.

What is inflation?

The word inflation, draws upon the root word, inflated. In economic terms, inflation is described as an increase in the price of goods and services in an economy. Inflation measures the increase in these prices and is represented in percentage terms.

For example, if a loaf of bread costs you $5 last month, and now costs $5.50, that is a 10% increase in prices. Thus, one can say that the price for a loaf of bread rose 10% in a month. This is nothing but measuring inflation, albeit for just one item.

One way to look at the above example is by saying that it now costs more dollars to buy a loaf of bread than it did, one month ago. Thus, the purchasing power has been reduced. One of the most widely used examples when it comes to inflation is the Big Mac Index.

The Big Mac Index

The Big Mac Index is the simplest of all and perhaps something everyone can relate to, at least those who have had a bit at Mcdonald's at least once. The Big Mac index measures the cost of a Big Mac across different countries.

Using this, one can then learn how expensive or cheaper an economy, and thus by extension, its current rate is. You can view the real-time data from the Economist’s website. You will have to first set a base currency, which is usually the US dollar.

From here on, depending on the country you choose, you will get the price of the Big Mac for that country. The exchange rate is derived and compared against the actual market exchange rate. This in turn finally tells you whether the foreign currency is overvalued or undervalued against the US dollar.

When one talks about inflation, it has a broader meaning. Inflation, as we mentioned is the measure of price increase (or decrease). This is tracked by what is known as CPI.

What is Consumer Price Index?

Consumer price index or CPI is a common economic term used across the world. The CPI is an economic indicator that tracks the changes in a basket of goods and services. Depending on the economy in question, CPI can vary.

For example, in the U.S, the CPI index is calibrated to 100 and is tracked from there, on a monthly basis. Thus, an increase in CPI to 125, means that consumer prices rise 25% on a month-over-month basis.

The most common period is a quarterly period, although some economies such as the Eurozone also release consumer prices on a monthly basis. The quarterly period is then annualized and compared to the same period last year.

Thus, when you read the headline that states, “New Zealand inflation touches 7.3% in the June 2022 quarter” it means that consumer prices rose 7.3% compared to the same period a year ago or in June 2021.

Different types of Price Indexes

CPI may be one of the most common terms you may hear, but there are many others too. Traders would be especially familiar with another aspect of CPI called the core-CPI. The Core CPI excludes volatile items such as food and energy prices.

The core CPI is thus smoother compared to the main CPI or the headline CPI. Still, in general, terms, when one talks about inflation, they refer to the CPI, also known as the all-items CPI.

It is up to each individual country’s economics department on how they wish to calibrate CPI. Thus, the basket of goods and services may vary depending on the unique characteristics of each economy. But the output is expected to give more or less the same idea of prices.

Besides the consumer price index, another component of measuring inflation is the Producer price index.

Producer Price index

The producer price index or most commonly called “factory gate inflation” is a measure of the general increase in the cost of goods and services used for manufacturing. These items are quite different from the items you find in the consumer price index.

The purpose of the producer price index or PPI is to measure the cost of goods production. This can include household utilities such as televisions, refrigerators, and cars to heavy industrial items as well. An increase in prices for raw materials usually propagates into an increased cost for the manufactured goods too.

Producer prices tend to have a bigger impact on the fact that some of these manufactured goods are also exported. Thus it can have a significant impact on a country’s balance of trade. If the cost of goods produced is higher, then they cost more, reducing their price-competitiveness in the markets.

Both the consumer price index and producer price index give a general overview of the costs of the goods and services produced and purchased in the economy.

The link between inflation and GDP

Connecting the dots, it is now easy to see why inflation matters. When things get more expensive to buy, people tend to cut back on spending. This in turn leads to lower economic activity. Lower economic activity leads to reduced business expansion and thus the hiring cycle.

Therefore, central banks usually try to keep inflation stable. Many major central banks in the world maintain a dual mandate. The dual mandate signifies that the central bank’s main task is to ensure price stability (stable inflation) and also economic growth via stable employment.

Central banks that have a dual mandate include the US Federal Reserve, with the Reserve Bank of New Zealand adopting a dual mandate in June of 2019. The dual mandate makes it even harder for central banks to implement their monetary policy tools, especially during recessionary periods.

What influences inflation or consumer prices?

By now you may be wondering what influences the inflation rate or consumer prices. There are a number of reasons behind this. Each of these reasons is credible enough to impact inflation. The first and foremost is more money circulation.

Excess money circulation

When there is more money in circulation, there is plenty of it to go around. This can spur consumers to spend more. A classic example of this is the central bank’s quantitative easing.

The US Federal Reserve, in the aftermath of the 2008 global financial crisis started pumping more money into the economy. Also known as quantitative easing, the excess money was circulated by lowering interest rates. This makes borrowing costs lower to encourage banks and businesses to borrow more.

The excess money is aimed to stoke economic growth, but it has its negative consequences too. Too much extra money can quickly lead to higher prices as demand for goods and services grow.

Lower interest rates

Lower interest rates go almost hand in hand with excess money circulation. The only difference with such a monetary policy tool is that the central bank does not specifically target flooding the economy with more money.

On the other hand, lower interest rates aim to loosen credit conditions in an economy to help businesses and consumers borrow more. This borrowing is usually seen among business expansions, or in the mortgage markets.

Lower interest rates spur economic activity, but if not managed can lead to inflationary pressures.

Oil and energy prices

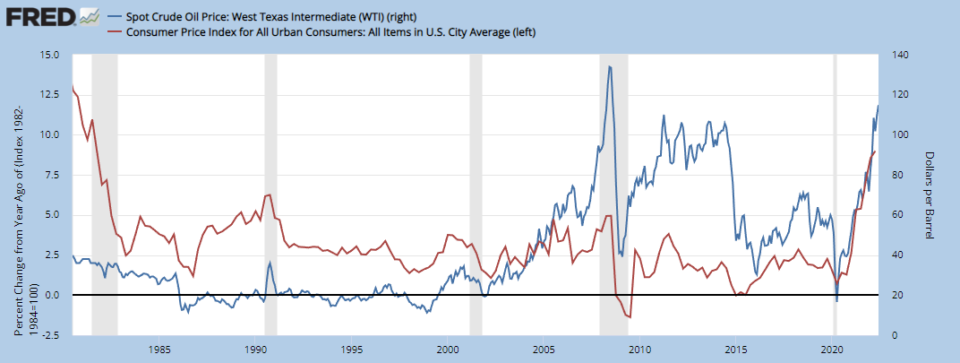

Crude oil, and hydrocarbons remain the lifeblood of the global economy. Whether you want to ship products from one part of the world to another, or even transport goods from the warehouse to the retail store, fuel is needed.

Thus, oil prices are very crucial and play a significant role in the context of inflation. Higher fuel prices automatically raise the costs of goods transported. This in turn is felt in the retail prices one gets to see when at the store.

The above chart shows the inflation rate on the left y-axis with oil prices on the right side.

You can see how higher oil prices during normal economic conditions tend to push consumer prices higher as well. As of 2021, we can see a strong surge in oil prices with inflation moving in the same direction.

The US dollar

The US dollar is the world’s reserve currency. Much of global trade is settled in the USD. Therefore a stable USD is required in order to keep prices of commodities steady. When the US dollar appreciates across the board, countries that import commodities need to spend more.

Thus, the more expensive the dollar gets, the more the cost of imported goods increases. This can be a major issue for economies that are heavily reliant on imports. Take, for example, crude oil which is settled in USD.

Assuming a barrel of oil costs $100 for a country whose exchange rate was at $5. Now if the exchange rate rose to $10, then the country needs to double its spending to buy the same barrel of crude oil.

The US dollar is a free-floating currency whose value is set by the market dynamics. During times of global crisis, the US dollar is a safe haven. We saw this classic example during the Covid-19 pandemic when the dollar appreciated.

Similar trends can be seen since early 2022 with the onset of the Russian war on Ukraine. Investors pile on to the global safe haven status of the greenback. This can in turn creates inflation pressures on various economies.

What are the reasons for high inflation in 2022?

By now you already have some idea of what inflation is all about and the different types of inflation and how they are measured. We also briefly covered a few reasons why inflation can rise. This brings us to the next point about why we are seeing such high inflation suddenly.

There are a number of factors behind this.

The two main reasons are the subdued demand we saw during the Covid-19 pandemic. Following the lockdown of various economies, demand fell sharply leading to a brief recession globally.

However, as economies began to re-open demand started to rise, pushing prices higher as the dollar continued to remain strong. There is a lot more behind just the above answers, which we will cover in the next article.

For now, we conclude with a quick recap of some of the key terms covered in this article.

Key Terms:

Inflation: Inflation tells you how expensive goods or services are, compared to a period. Inflation is derived from the CPI or the Consumer Price Index.

Deflation: Deflation is the opposite of inflation and it measures the decrease in the cost of goods and services in an economy. Similar to inflation, deflation is also derived from the CPI.

Stagflation: Stagflation is a unique case as it partly measures the increase in the cost of goods and services in an economy. However, this is very specific to the economic conditions where the economy is not growing. Stagflation is also referred to as recession inflation or inflation in recessionary periods.

Consumer Price Index (CPI): Consumer price index, is an index that measures the overall change in a basket of goods and services over time.

Big Mac Index: The Big Mac Index is a term coined by The Economist as a way to measure the cost of “the big mac” in different countries. The Big Mac Index basically tells you how expensive or cheap it is, to buy a Big Mac in London, compared to New York.

Purchasing Power Parities (PPP): Purchasing power parity is a widely established economic theory that indicates the price level differences across different countries.